Did you know that not all income is equal? Or that the income that most of us spend our lives trying to obtain is one of the most heavily taxed? It’s true, we spend the majority of our lives working overtime hours, taking calls on weekends, and sucking up to the boss(es), in exchange for one of the least efficient forms of income in existence.

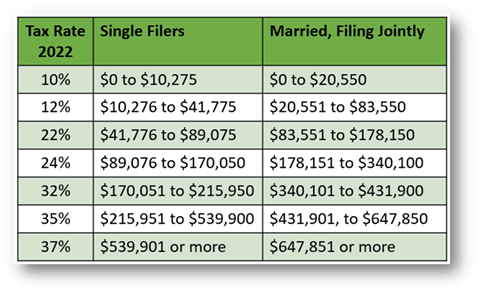

For most of us, one of our work goals is to make a six-figure income. Then if we are lucky enough to obtain that goal, some of us find out that we aren’t making all that much more than we were previously. And who do we have to thank for that? Why good ole Uncle Sam and the IRS’s progressive tax system. In this system, as we make more W-2 income, we pay a higher percentage of that income in taxes. To get a better sense of the rates at play, let’s look at the current rates for 2022 in the chart below.

Federal Income Tax for 2022

But Federal taxes aren’t the only reason W-2 income sucks. We can also thank self-employment or Federal Insurance Contributions Act (FICA) taxes. As of this writing, for any W-2 income we earn, we pay 7.65% in taxes (6.2% Social Security + 1.45% Medicare) and our employer matches by paying an additional 7.65% in taxes. Sure, we split the total 15.3% in taxes (7.65% each), but it’s still a built-in cost for the employer and is reflected in the amount of compensation they can offer us.

Out of curiosity, what was your federal tax rate from above? Don’t forget to add another 7.65% to your federal rate to account for FICA taxes. Now, what’s your number? I bet it’s not lower than 20% and if it is, it’s certainly not taxed at 0%.

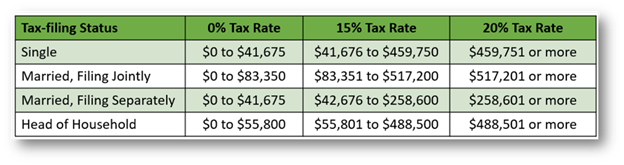

So, if W-2 income isn’t all it’s cut out to be, then what is? Well, one way we at Poor Dads Investing have been increasing our income every year, while decreasing our effective tax rate, is through qualified dividends. Payments from qualified dividends are taxed as long-term capital gains which means we keep more of the money we make. Not sure what the current rates and limits are? Check out the 2022 capital gain tax rates for qualified dividends below:

Long-Term Capital Gains Tax for 2022

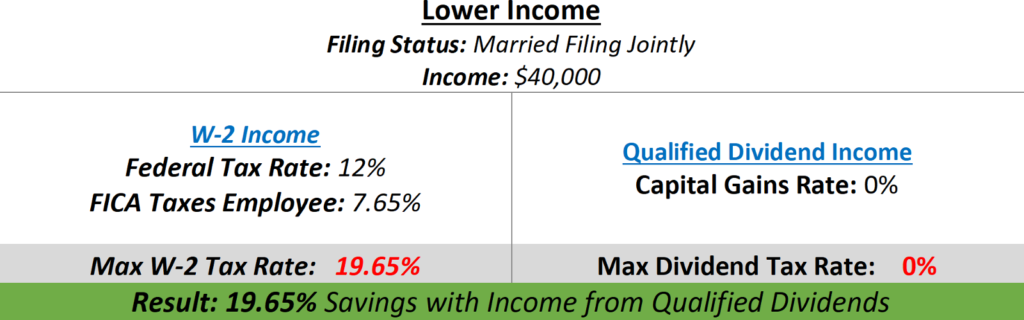

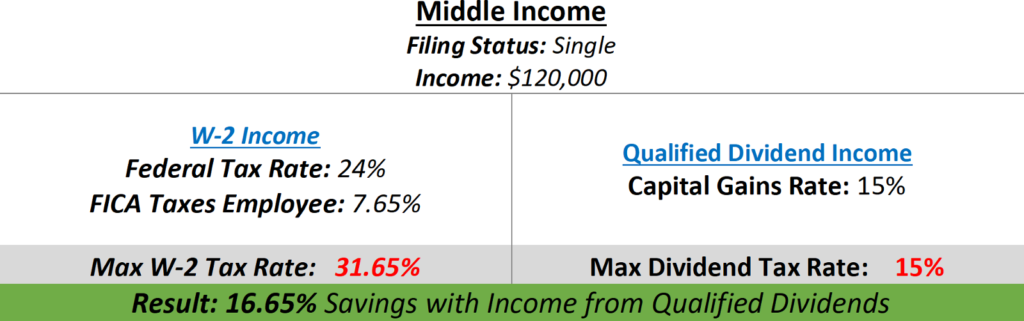

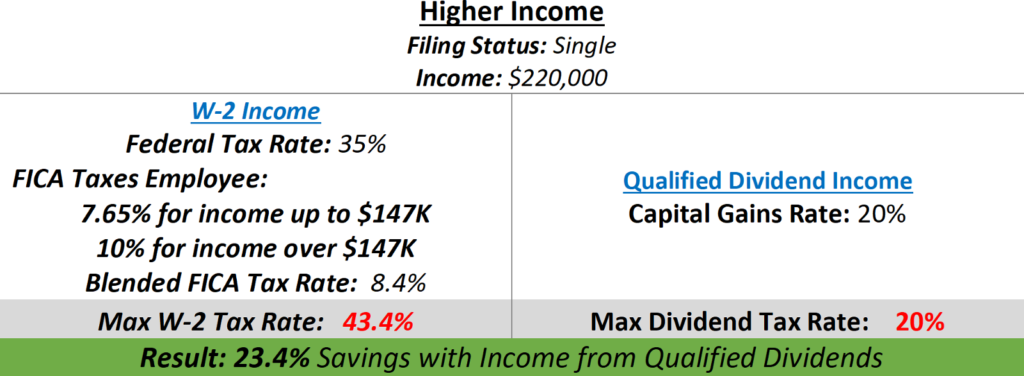

To further illustrate how this increases our income while reducing our effective tax rate, let’s look at a few income examples:

As we can see from the examples above, qualified dividends are one of the best sources of income because of their tax treatment (0%, 15%, 20%). They aren’t taxed for Social Security or Medicare, and we can benefit from them regardless of our income level. That’s why every year, our aim should be to trade in as much of our less desirable W-2 income as possible, for more desirable, qualified dividend income. If we can do this, we will see our income increase every year, while seeing our effective tax rate decrease. That my friend is a beautiful thing!

Don’t know what Qualified Dividends are? No worries! We have a course that was made just for you. Register for our Dividend 101 course here.

Not part of the free Poor Dads Investing discord community? Sign up here